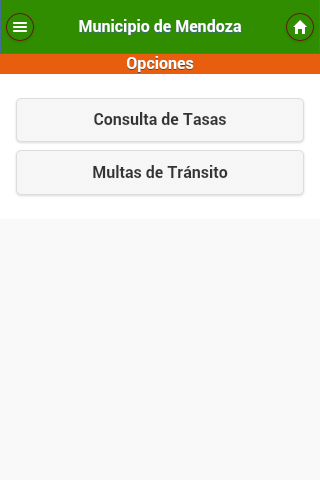

| App Name | Tasas y Multas |

| Developer | Ciudad de Mendoza |

| Category | Finance |

| Size | 2.30M |

| Latest Version | 1.0.4 |

Key Features of a Tasas y Multas System:

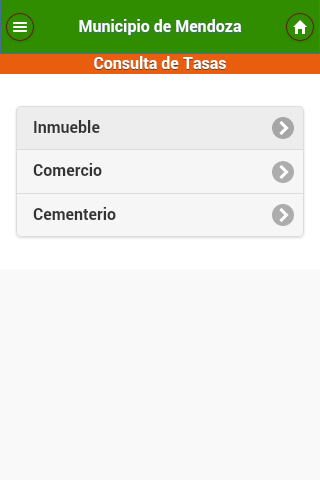

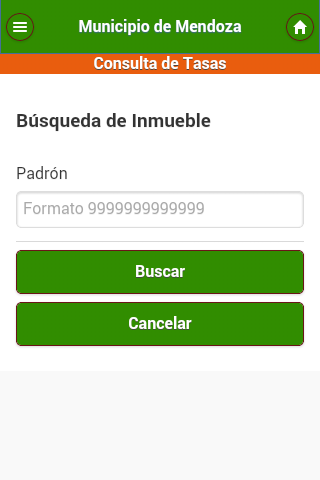

- Streamlined Payments: Facilitates convenient payment of municipal fees (property, cemetery, advertising) and fines. Users can opt for email receipts and generate electronic payment records.

- Online Accessibility: Enables secure online transactions through established payment networks like Banelco and Link Payments, eliminating the need for in-person visits.

- Mobile Integration: Seamlessly integrates with popular mobile banking apps such as "BanelcoMOVIL" and "Link Cell" for enhanced user convenience.

- Accrual and Payment Plan Management: Automatically calculates accruals and provides clear information on payment plan deadlines and enforcement procedures.

Frequently Asked Questions:

- Data Security: The system prioritizes the security of personal and financial data during online transactions.

- Cross-Jurisdictional Payments: The system is specifically designed for municipal fees and fines; it may not be compatible with penalties from other jurisdictions.

- Email Receipt Delivery: Receipts are typically emailed immediately after payment, though occasional delays due to technical issues may occur.

▶ What are Tasas?

Tasas, or fees, are charges levied for accessing specific services or completing administrative procedures. These vary depending on the service provider. Examples include:

- Banking Fees: Maintenance, transfer, and transaction charges.

- Service Fees: Payments for utilities (water, electricity, waste disposal).

- Municipal Taxes: Local government charges for services like road maintenance or public safety.

Tasas are generally predictable and governed by established guidelines, allowing for budgeting.

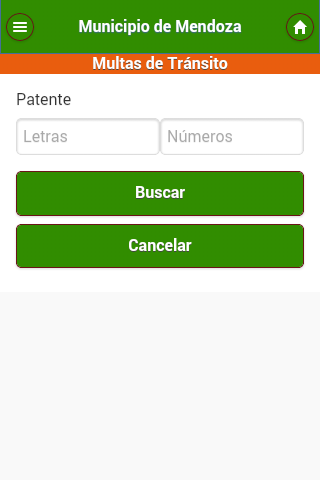

▶ What are Multas?

Multas, or penalties, are fines resulting from violations of laws, rules, or regulations. Unlike tasas, they are punitive measures for non-compliance. Examples include:

- Traffic Fines: Penalties for speeding, traffic signal violations, etc.

- Tax Penalties: Fines for late or inaccurate tax filings.

- Business Fines: Penalties for non-compliance with labor laws, environmental regulations, or safety standards.

Multas aim to deter unlawful behavior and encourage adherence to regulations.

▶ Effective Tasas y Multas Management:

Proactive management of tasas y multas is essential. Consider these strategies:

- Compliance: Adhere to all applicable rules and regulations to avoid penalties.

- Deadline Awareness: Maintain awareness of all payment and submission deadlines.

- Statement Review: Regularly review bank and service statements to identify unexpected fees.

- Local Regulation Understanding: Familiarize yourself with local tasas y multas structures.

-

Marvel Rivals Season 1 Release Date Revealed

Marvel Rivals Season 1 Release Date Revealed

-

Sonic Racing: CrossWorlds Characters and Tracks Revealed for Upcoming Closed Network Test

Sonic Racing: CrossWorlds Characters and Tracks Revealed for Upcoming Closed Network Test

-

Honkai: Star Rail Update Unveils Penacony Conclusion

Honkai: Star Rail Update Unveils Penacony Conclusion

-

Announcing Path of Exile 2: Guide to Sisters of Garukhan Expansion

Announcing Path of Exile 2: Guide to Sisters of Garukhan Expansion

-

Ubisoft Cancels Assassin's Creed Shadows Early Access

Ubisoft Cancels Assassin's Creed Shadows Early Access

-

Optimal Free Fire Settings for Headshot Mastery

Optimal Free Fire Settings for Headshot Mastery